Brand Valuation

What is a brand?

The strength of a brand is reflected in the impact it has on the minds of consumers, the ease with which it can be remembered, since a brand summarizes the concept of a company., according to international trademark appraisers “The trademark is not only something that serves to identify a product, but also an instrument of legal protection.” This is why it is important to carry out a brand evaluation.

The World Intellectual Property Organization (Mexican Institute of Industrial Property in Mexico), defines a brand as “a name, term, symbol or design, or a combination of them, that seeks to identify the goods and services of a merchant or group of merchants and that allows differentiation among competitors.”

Brands are part of intangible assets; intangible means something that lacks physical substance.

What is brand valuation used for?

Currently, the brand as an intangible asset represents one of the main assets of companies, being at the same level as other fundamental assets for the development of a business activity, such as machinery, facilities, stocks, etc. However, the accounting regulations that are currently applied do not allow the recording of intangible assets generated internally in the company itself (with the exception of R&D projects), beyond their cost value.

In this case, International Financial Reporting Standard number 3 is taken into account (“IFRS 3"), in which it is established that those who acquire a company must make a Distribution of the Acquisition Price by recognizing the assets (including those that have not been previously accounted for by the acquired business) and liabilities assumed, at their Fair Value at the date of acquisition.

This International Standard indicates that "an asset is a resource that is controlled by a corporation as a result of past events and which is expected to generate future economic benefits", among the examples we can talk about the sale of products or services, savings of costs or other economic benefits resulting from the exploitation of the asset.

Financial Reporting Standard C-8, defines intangible assets as follows: “They are identifiable non-monetary assets that do not have physical substance and that will generate future economic benefits that are controlled by the entity.”

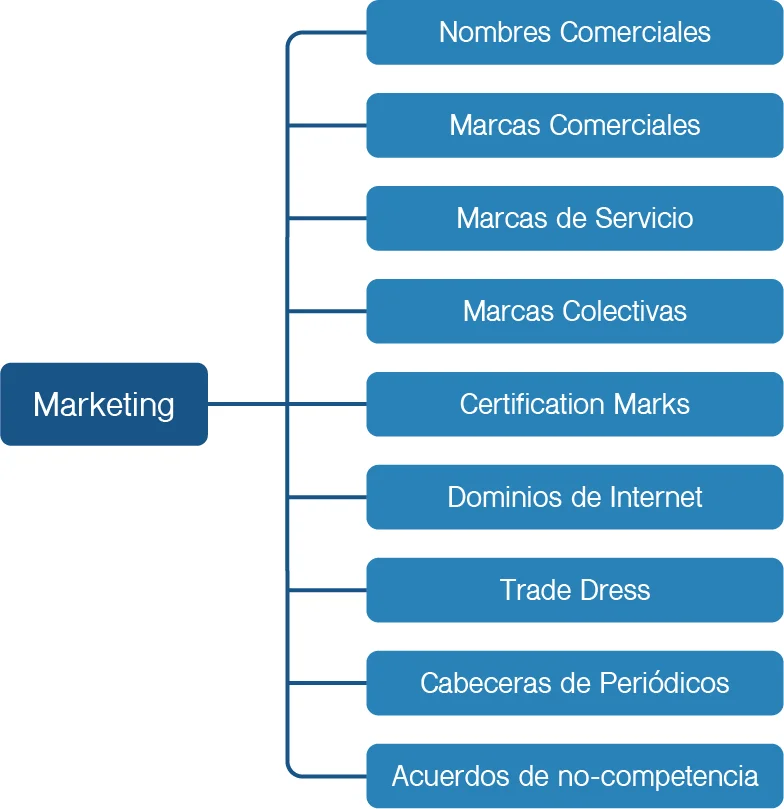

Intangible assets are known as properties with great value, and among them, possibly the most valuable, but least understood, are brands., brands are part of the classification of intangible assets in the classification called Marketing.

The brand valuation allows to determine its economic, financial or monetary value.

The ISO 10668 defines the value of a brand as: “The monetary value of a brand represents the economic benefit that said brand produces during its expected useful economic life.”

Factors to consider when valuing a brand:

- Brand strength.

- Probability of entry of competing brands.

- Brand protection (Property Registry).

- Brand reputation.

- Distinctive of the brand (probability of being cancelled).

- Development or Incorporation Sector

What characteristics does the brand appraisal have?

At present, brands have acquired great importance, their valuation has become one of the most interesting fields for appraisers, since in brands the consumer is the one who determines their greater or lesser value at a great level.

It can be said that the brand assessment will reflect how much it is worth, according to consumers.

How is a brand valued?

It is important to accurately identify which valuation techniques or methods are most appropriate to the circumstances, on which there is sufficient information and data to measure the fair market value of the Brand. As appraisers, we must maximize the use of more observable and relevant input data.

The objective of using a valuation method is to estimate the fair market value at which an orderly transaction to sell the asset would take place between market participants in the period in which current market conditions are measured. Similarly, for any other purpose, the appraiser will identify the most appropriate method.

IFRS identifies three widely used valuation methods: the market approach, the cost approach and the income approach. It also states that an entity will use valuation methods consistent with one or more of those approaches to measure fair value.

Judgment must be used to establish whether the fair value of the Mark can be determined with sufficient reliability with each of the aforementioned methods.

For example, when there is an observable market for buying and selling transactions of comparable brands, we may use the market approach. However, when this data set is poorly observable and there is not enough comparable data within the market, the other two approaches will need to be considered. The same will happen for the income and cost approach. For the income approach, it will be very important to count the financial statements of the business, and apply the most assertive valuation methods.

In this way, as a valuation unit, the most appropriate valuation criteria and methods will be applied for the circumstances in which said brand or intellectual property is found.

IFRS Foundation. (2019). IFRS 13 Fair Value Measurement. 2020, from the IFRS Foundation Website: www.deliotte.com

What methods are used in brand valuation?

COST APPROACH

This method is recommended for those brands that were created recently.

When a brand is created, costs are incurred, which appear from the creation of its name, logo, to the investment destined to gain a place in the market.

This method is based on factors such as:

- Graphic designer cost.

- Salaries of the people who participate in the porting of ideas for the name.

- Advertising expenses.

- Marketing expenses

The appraiser requires receipts showing how much it cost to create and develop the brand, as well as invoices for the services provided by the graphic designer and budgets for advertising and marketing campaigns.

MARKET FOCUS

To execute this method, it is necessary to know the value of the brands that are similar to the brand that will be valued.

Here the appraiser carries out a market investigation, which allows obtaining a value that will be closest to reality and the accuracy of said value will depend on the size of the sample that has been analyzed.

In order to carry out the aforementioned, it is necessary to have information that allows knowing how much the brands that are part of the valued brand are quoted, within a certain period of time.

INCOME FOCUS

This method is characterized by projecting the value of the brand into the future.

Here, cash flows (which must be verifiable through fiscal years) and intangible values must be considered.

To carry out the calculation, it is necessary to present financial statements of the last five financial and audited years. Financial statements showing how much the brand bills for the business may also be needed.

Why is it necessary to carry out a brand valuation?

Today, intangible assets represent a high percentage of companies' wealth, for this reason estimating their value is becoming increasingly important. The most important reasons why it is necessary to carry out a brand assessment will be listed below.

- Allows you to sell a product at a higher price and/or increase sales volume.

- It helps to better define the corporate mission.

- It gives a more accurate view of the value of the company.

- It is the basis of a buying or selling process.

- Improves negotiation with financial institutions.

- It can serve as collateral for loans.

- Recognition in financial statements increasing the capital of the company.

- Tax Deduction Benefit

Standards and Certifications

We follow the corresponding and current regulations. We have the necessary certifications to provide a reliable and comprehensive service.

Some customers of this service