Aircraft Appraisal

Aircraft, as is normally the case with other types of transport, must undergo maintenance, which must be carried out periodically so that they can be valued with greater precision. It is important to keep a record of the changes that have been made. carried out on the parts and components, since these can change the valuation of the aircraft and therefore its market value.

What is aircraft valuation?

The valuation of aircraft allows to know the market value of airplanes, helicopters, balloons, airships and drones.

Aircraft are classified into two types of groups: commercial and military aviation, commercial aircraft being the only ones that are subject to compliance with certain standards, which are important when carrying out the valuation of aircraft because it depends on compliance with said standards that this type of property can be retain its value.

Why is aircraft valuation important?

The aircraft valuation provides relevant information on the current state of the aircraft under study, which can serve as a reference to obtain a report that can help decision-making regarding the aircraft in question, in which the state is detailed. and current value of the same, such as knowing the times in which a change of parts was made, each time it receives maintenance, etc.

The condition of the aircraft results from pondering the variables of its state and conservation, such as upholstery, instruments, crystals, avionics, etc. The use of a rating table allows for a more objective assessment.

Most Common Aircraft Appraisal Methods:

To carry out the valuation of an aircraft it is crucial to carry out:

- A study of the physical condition of the aircraft.

- Review your documentation, such as the logbook of certain elements of said aircraft, review of manuals, the record of incidents, major repairs, etc.

- Review the traceability of the aircraft, which refers to the information on its equipment, technology, type of materials, environmental assessment, etc.

To carry out the valuation of aircraft it is necessary to adhere to the International Valuation Standards (NIV), where the following three major areas that the valuation involves are marked:

cost approach

This approach refers to replacement or reproduction, which is proportional, in the field of insurance, to an equivalent utility. This approach also responds to a principle of substitution, calculation, estimation of demerits, depreciation, etc.

market focus

It provides information that allows access to comparative homologation methods that allow supply and demand to be analyzed, allowing recent purchase and sale operations to be analyzed and available to have clearer references.

This approach makes it easier to have the necessary tools to carry out the appraisal, since there is a wide range of comparable elements available.

This approach makes it possible to determine the valuation of aircraft that are for commercial use in terms of their typology, that is, the valuation of the commercial aircraft in question will depend on its use, for example, it can be an air taxi, passenger transport , transport of goods, transport of loads, etc.

The present value of future benefits, capitalization of income, cash flow is analyzed.

Why is it necessary to perform an aircraft appraisal?

Performing the market value valuation of an aircraft, provides the interested party with information that allows him, for example, to carry out the sale, purchase financing, insurance claim, lease-back, etc.

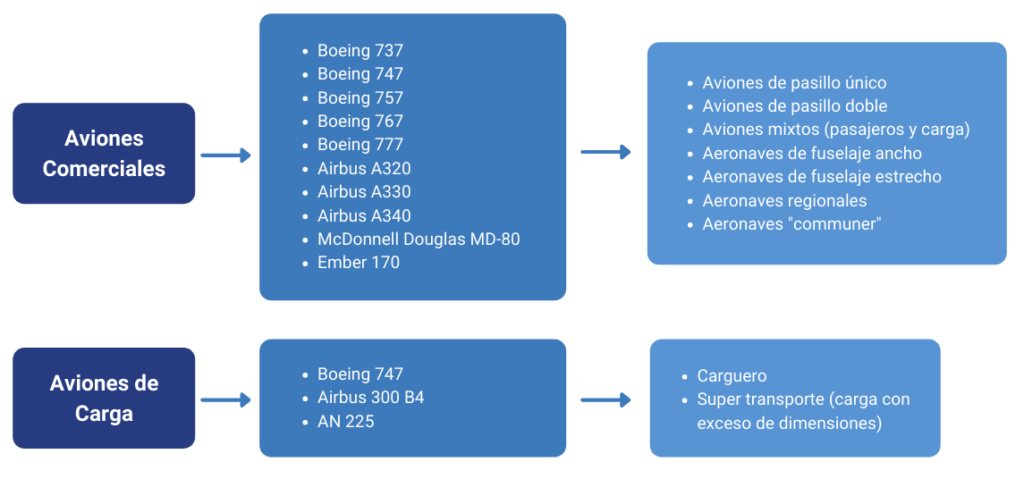

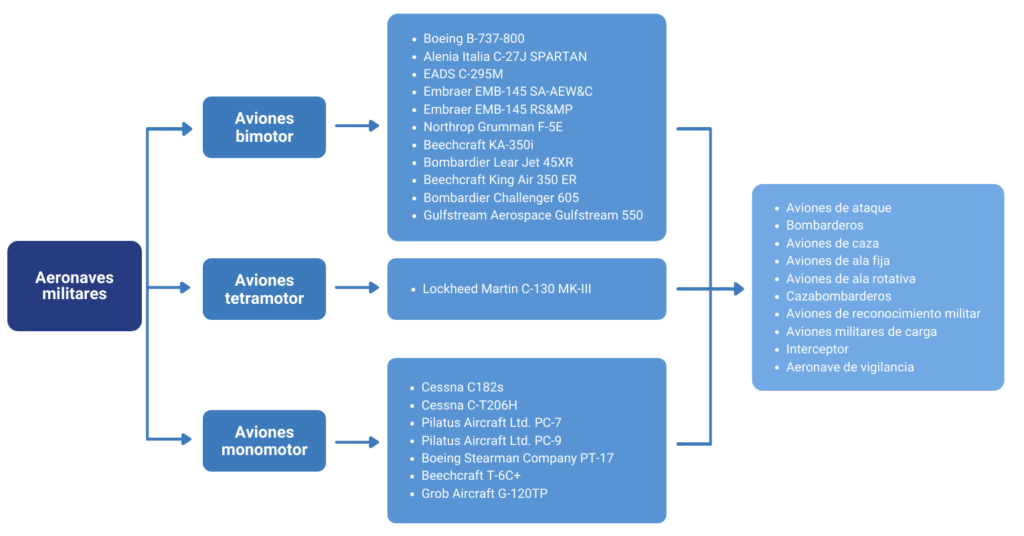

What types of aircraft do we value?

| twin engine aircraft | – Boeing B-737-800 – Alenia Italy C-27J SPARTAN – EADS C-295M – Embraer EMB-145 SA-AEW&C – Embraer EMB-145 RS&MP –Northrop Grumman F-5E –Beechcraft KA-350i – Bombardier Lear Jet 45XR – Beechcraft King Air 350 ER – Bombardier Challenger 605 – Gulfstream Aerospace Gulfstream 550 |

| four-engined aircraft | – Lockheed Martin C-130 MK-III |

| single engine aircraft | –Cessna C182s – Cessna C-T206H – Pilatus Aircraft Ltd. PC-7 – Pilatus Aircraft Ltd. PC-9 – Boeing Stearman Company PT-17 –Beechcraft T-6C+ – Grob Aircraft G-120TP |

| commercial aircraft | – Boeing 737 – Boeing 747 – Boeing 757 – Boeing 767 – Boeing 777 –Airbus A320 –Airbus A330 –Airbus A340 – McDonnell Douglas MD-80 –Ember 170 | – Single aisle aircraft – Double aisle aircraft – Mixed aircraft (passengers and cargo) – Wide-body aircraft – Narrow-body aircraft – Regional aircraft – Communer aircraft |

| cargo planes | – Boeing 747 – Airbus 300 B4 – AN 225 | – Freighter – Super transport (load with excess dimensions) |

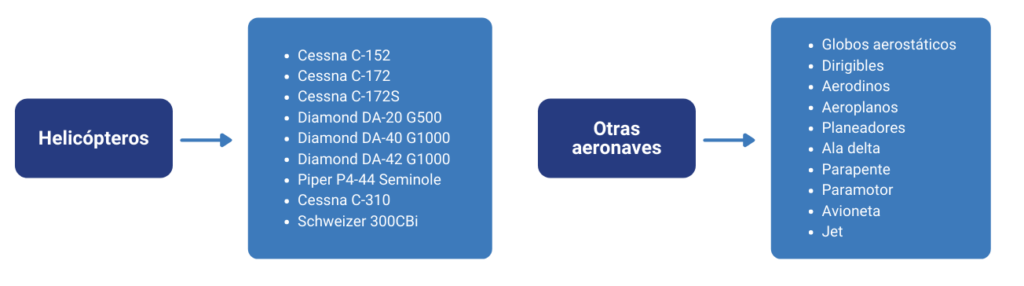

| helicopters | –Cessna C-152 –Cessna C-172 –Cessna C-172S –Diamond DA-20 G500 –Diamond DA-40 G1000 –Diamond DA-42 G1000 –Piper P4-44 Seminole –Cessna C-310 –Schweizer 300CBi |

| other aircraft | – Hot air balloons – Aircraft – Airplanes – gliders - Delta wing – Paragliding – Paramotor – Plane –jet |

airport appraisals

Airports are extremely important spaces within cities, since they are where some of the strongest movements of people and merchandise occur, which allows foreign investment to exist.This is because they help the economic development of any place, they also improve job opportunities and generate a large number of jobs both inside and around the area.

Factors used to determine the market value of an airport area:

- Size of the metropolitan area

- airport location

- Airport classification, size and function

- Number of operations

- Number of aircraft based at the airport

- Fixed operators and the services they provide

- Fuel sale amount

- airport amenities

- Evaluated plot size

- correct operation

- Highest and best use of property

What methodologies are used?

One of the best methods that can be used to carry out an airport appraisal is the Discounted Cash Flow method, since this method allows to know the operating expenses, as well as the investments or disinvestments that are made in the period of operations and those that will follow

For this reason, airports are considered going concerns, which show a constant flow of cash; however, the complexity in these studies results in the analysis of some areas being more uncertain than others.

In view of this, what is recommended is that various valuation methodologies be applied to fully disclose the value of the airport area and go hand in hand with experts specialized in airport appraisals.

Who can perform this type of appraisal?

Due to the level of technical knowledge and experience that is required, it is important that these types of appraisals are carried out by expert appraisers specialized in airport properties or by appraisers that have already had experience in carrying out airport appraisals.

Why is airport valuation important?

One of the main reasons why it is important to carry out an airport valuation is that it allows establishing the contractual obligations of the sponsors and owners of the airport area, so that the necessary permits and insurance can be granted to have an adequate operation. .

Another aspect that is considered is that the valuation of airports is a fundamental piece to guarantee the financial and economic sustainability of the airport, since this directly affects the financial depreciation that is made of the property in the market.